News

Please Stop Spending!

Friday 2nd September 2022

There’s been a considerable amount of doom and gloom, particularly about the UK economy, inflation, and interest rates with what seems to be a “Top Trumps” scenario of ever-increasing predictions of higher inflation. Governor Bailey seemed to set this off when the Bank of England met on the 5th August, increasing interest rates by 0.5% and predicting we will be in recession by the end of the year and lasting all of 2023, with inflation peaking at 13.3%. With price caps ending and gas and oil prices having risen so much energy represents 6.7% of this. Natural Gas prices over a year are up 6 times in Holland, 5 times in the UK and 3 times in the USA. The USA has a high level of domestic gas production, but even so has pushed 1 in 6 households there into arrears with their utility bills.

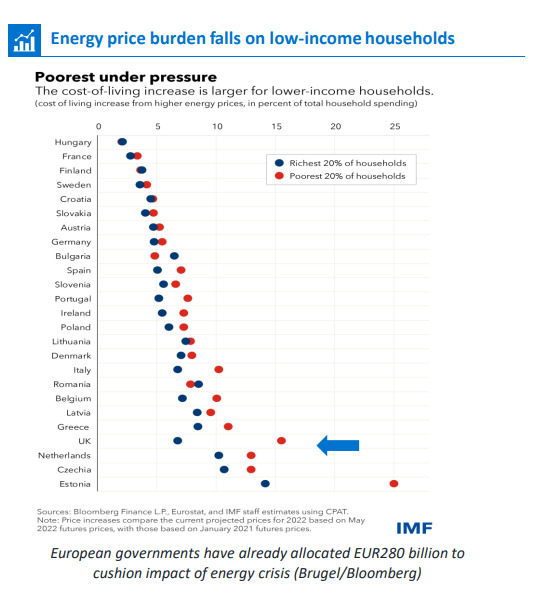

Rightly so in the UK, following the revised energy price cap, there is a focus on whoever is the next Prime minister will need to help those on lower incomes. This is highlighted in the chart below which shows the amount of household disposable income that will be eaten up by the increase in energy prices, with the UK having the widest gap on the impact between richest and poorest 20% of households, with the poorest spending 15% of their net income on energy. Our new Prime Minister cannot ignore the measures needed to soften the blow on the poorest, who will be impacted most, and needs dealing with in a similar way to how the Furlough Scheme helped.

The UK’s inflationary environment continued to worsen as the consumer prices index (CPI) rose to 10.1% in the year to July, up from 9.4% the year before, the highest level in 40 years, with the Resolution Foundation thinktank forecasting it could reach as high as 15% and leading to US Financial Services Group Citi predicting inflation of 18% early next year.

Raising interest rates is the main tool used by central banks when the economy is booming, so why are they doing it with a backdrop of such doom and gloom?

The current inflation figures are supply led, i.e. more demand than a very limited supply. What the Central Banks don’t want is for inflation to become embedded that will get out of control such as we experienced the 1970s. So Andrew Bailey and his committee want you to stop spending which reduces demand that helps with the supply issue. There is some evidence of this working with Data Company GfK produced a monthly survey on consumer confidence, which in August 2021 was -8% and in August 2022 was at -44% it’s lowest on record.

However, the Central Bankers also want the demand for wage rises to be restrained. In the US we today see the monthly update of employment data and is expected to show that another 300,000 jobs were filled in August, with 2 vacancies for every applicant. That is slightly down from July’s reading, but is still robust. Fed Chairman Powell’s speech at last week’s annual Economic Symposium, bluntly warned that combatting inflation would likely “bring some pain to households and businesses”. He reiterated that the US central bank would keep raising rates and probably leave them elevated for a while to reduce inflation thus trying to show strength and purpose. Markets reacted, by increasing expectations for interest rate hikes, with equity markets selling off in the aftermath, which has continued into this week. In a way this is welcomed and has brought back some reality following the recovery and exuberance through July and August.

So recession projected and publicised is preferred to inflation and on this aspect if you think your Employer may have difficulties in a recession you may not ask for such a high wage rise as ultimately you end up with no wages if made redundant. Likewise, Companies will look at their budgets and may not be so keen to take on new employees as they become conscious of a lack of demand seeing their costs spiral and remember they don’t have an energy price cap. For once the media doom and gloom machine may help our central bankers if it does lead to wage rise restraint.

Follow the Money

Many of you will have heard us use the expression of “follow the money”. It focuses on our belief that some of the best investment opportunities lie in the environmental and overall sustainable areas as Government and Private Companies focus their expenditure in this area. Soaring energy prices you’d think would detract from the investment in this area but is in fact the opposite.

The US

Last month, the US passed a historic Inflation Reduction Act. Whilst many countries have recently approved climate packages and enforced regulation, the size and scope of this Act should not be underestimated. It represents more than $370 billion of investment and subsidies to be spent over 10 years dedicated to climate and energy measures. These include tax credits for electric vehicles, $20bn spent on clean vehicle manufacturing facilities, 10 years of consumer residential energy tax credits and $20billion to support climate-smart agricultural practices. It is a big feather in President Biden’s cap.

The EU

In response to the outbreak of war in Ukraine, the European Union published their plan to reduce reliance on Russian oil and gas. This represents spending of circa €300bn by 2030 and includes investing in solar and wind power, energy storage investment, green hydrogen innovation and promotes awarding of permits to renewable energy projects.

China

We often hear of China being the world’s largest polluter yet hear very little of their sustainable spending. Last year, China accounted for 46% of the world’s new construction of renewable energy infrastructure, investing $380bn, more than any other country during 2021. China’s solar energy spending for the first six months of this year has totalled $42 billion (173% higher than last year). The country’s spending on new wind projects totalled $58 billion (107% above 2021 levels). According to China Renewable Energy Engineering Institute, the country is set to install a record 156 gigawatts of wind turbines and solar panels this year.

Our thanks to LGT for this information.

Finally to England where single-use plastic bag use has fallen by 20% after an increase in price from 5p to 10p last year. The average person now buys around three single-use carrier bags a year compared with 140 bags in 2014. Since charges were first introduced in 2015, total usage in England has decreased by 97% BBC

Bailey Cook Christmas Drinks and Nibbles

Please pencil in the 7th December from 7.00 p.m. at The Roman Baths, a fantastic venue we’re sure you’ll enjoy. A formal invitation and more information will follow but we hope this year the Bath Christmas Market will be back and you can maybe combine the two. If you did wish to book a place now please let Sarah know sarah@baileycookfp.co.uk.

And remember if you are in Bath always feel free to drop in for a coffee.