Sustainable Investing

Supporting a sustainable planet

We have previously identified that there is a growing need for us to be able to offer Sustainable investment solutions for our clients.

Sustainability is a broad investment description, and as a firm we take it to mean solutions that invest in companies whose products and services have a positive impact on society. We understand that this is distinctly different from Ethical investment which is based on negative screening, and Economic, Social and Governance Investing (ESG) investing, which should be a core element of all fund managers’ mandates.

Several fund managers are now investing in line with common Sustainability definitions and objectives, such as the [United Nations (‘UN’) Sustainable Development Goals.

The Agenda for Sustainable Development 2030

In 2015, the UN created the Agenda for Sustainable Development 2030. The Agenda was developed in an effort to eliminate poverty and make a commitment to achieve sustainable development on an international level.

Through the Agenda, the UN and its 193 member states build on decades of a shared vision to create a sustainable world and a better future for all.

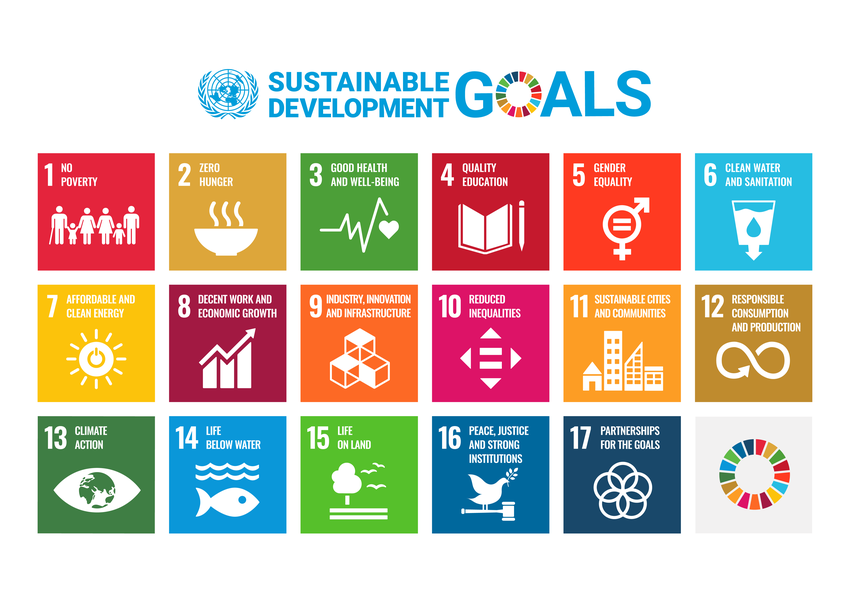

At the core of the Agenda are the 17 United Nations (‘UN’) Sustainable Development Goals. To continue this shared vision of humanity, the Goals provide a global framework for ensuring ongoing and increasing dignity, peace and prosperity for people and the planet. The Goals aim to make ambitious progress and combat a range of issues, including health, education, climate change, poverty, gender equality, sanitation, energy, social justice, and the environment.

They form a vital framework for both individual countries and our wider global community to ensure capital is channeled toward the areas that need it most. The Goals alone do not form a robust investment framework; however, they inspire a range of investment themes that incorporate many high growth sustainable trends.

Interest in sustainable investing continues to rise. According to the Standard Chartered Sustainable Investing Review 2020:

- Around 71% of the UK's affluent and high net worth investors are highly interested in sustainable investing.

- 45% said that over the next three years they would consider investing 15 – 25% of their available funds in sustainable investments.

- Over the next three years, 42 per cent of investors are considering investing 5 – 15% of their funds in sustainable investments, while 9% of investors indicated they would like to have 25% or more of their funds allocated to this area.

Government commitment also increased significantly

Numerous government policy responses throughout 2020 explicitly referenced climate change, and significant portions of the stimulus announced since March 2020 have been specifically directed towards tackling environmental issues:

- In September 2020, France announced a €100bn 'France relaunch' plan, which includes €30bn for four key ecological sectors, building renovations, transport, agriculture, and energy.

- Finland has committed €5.5bn for green transport.

- In the UK, Chancellor Rishi Sunak has earmarked £3bn for climate action.

- The European Council has announced a €750bn recovery fund, of which 30% will be spent on tackling climate change.

With this type of support, we believe the momentum behind addressing Sustainability issues will only grow stronger, and cannot be ignored.