Investing For Good

We believe there is a need for us to be able to offer ‘sustainable investment solutions’ for our clients.

Interest has grown and there have been significant, welcome developments in this area of investment in recent years. Previously, investing in this way could mean restrictive investment options, higher cost and potentially limited returns. We recognise that we are in a period of transition and the world is not perfect. However, with an increasing global focus on issues such as climate change and renewable energy, there is now a lot more choice available.

What is sustainable investing?

Sustainability is a broad investment description, and one that continues to evolve over time.

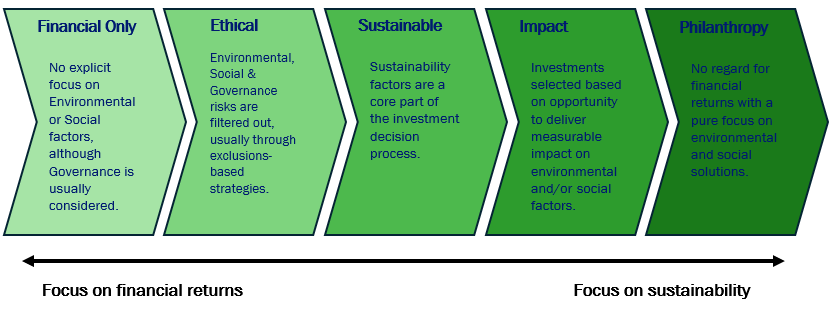

As a firm we take it to mean solutions that invest more in companies whose products and services have a positive impact on society, and less in companies who might have a negative impact. Our approach broadly follows the established ‘spectrum of capital’ model as shown in the picture above.

For example, some individuals wish to choose investments with the intention of creating positive social or environmental change over consideration of financial gain. This is known as ‘Impact investing’ and could include investments in renewable energy, housing, healthcare, and sustainable agriculture.

Other individuals may take a more, arguably, pragmatic approach where certain traditional investment sectors are screened out, thus avoiding entanglement with businesses that may conflict with their values. These could be companies that produce tobacco, armaments, adult entertainment or fossil fuels. However, such an ‘Exclusionary’ approach would normally allow a limited exposure to say, supermarkets, because only a small amount of their turnover is derived from tobacco and fossil fuels.

Next steps

When you appoint us as your financial adviser, we will take time to understand your current circumstances, financial objectives, attitude to risk and investment preferences. As part of the latter point, this involves understanding where you believe you sit on the investment spectrum. We will explain the features, benefits, risks and costs of the various investment solutions we can advise for you as part of your financial plan, so you can make informed decisions about how to proceed.

This is a very personal and emotive issue, and it is important for you to be comfortable with where your money is invested. We will not try to push you down one particular route. However, as part of prudent financial planning and diversification, we would rarely recommend that you invest all of your money in line with one approach.